is there a tax on death

In just about all cases the death benefits paid by insurance policies are free from income tax. 575 percent for the member and 075 percent for a surviving spouse pension.

An investor who bought Best Buy BBY in 1990 would have a gain of.

. Interest accrues on the funds during the delay and that interest is taxable when the funds are eventually paid out. Nonspouse beneficiaries will not have to pay estate taxes on an inherited 401 k because the estate is actually responsible for paying. Your executor will have to file an estate tax return if your gross estate.

First there are taxes on income or on capital gains earned during the last year of life. When a person dies the tax deadline is automatically extended to April 15 tax day of. If the payout does exceed the original purchase price only the amount over what was paid is taxable.

It falls on the heirs -- some of whom may be rich and some of whom may not be. Before June 1 2006 SLEP members contributed 650 percent of salary. Tax Treatment of Capital Gains at Death.

An estate tax is a tax on your right to transfer property after your death and accounts for everything you own or have certain interests in at the date of death. Some states also apply an inheritance tax in which the beneficiary could also be taxed after. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

Write deceased next to the taxpayers name when filling out tax forms. Members who participate in the SLEP plan contribute 750 of salary on and after June 1 2006 toward a future SLEP pension. Those states with a tax have a relatively high threshold before taxes are due.

What taxes apply after someone dies. Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be. The 38 tax on net investment income would continue to apply.

The estate tax is a tax assessed against your estate after you die. Purchased Pension Death Benefits Some death benefits purchased through a pension plan function similarly to life insurance which means theyre only taxable if the payout amount exceeds the purchase price. The estate tax which is levied by the federal government and certain states and the inheritance tax which is.

The death tax is any tax levied on property and assets being transferred from the estate of a deceased person. Death taxes are taxes imposed by the federal andor state government on someones estate upon their death. If you have a lot of property you want to leave to your children or other heirs it may be subject to taxation.

Deceased Persons Filing the Final Return s of a Deceased Person In general the final individual income tax return of a decedent is prepared and filed in the same manner as when they were alive. While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes. Youll have to pay taxes on any distributions taken out of the account at current income tax rates.

Fortunately these taxes are almost a thing of the past. An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS.

Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax will be calculated at the applicable personal income tax rates. Second there is interest or capital gains made on money in the estate. For the 2021 tax year the federal estate tax exemption was 1170 million and In the 2022 tax year its 1206 million.

This includes both the Federal estate tax and state inheritance taxes. All income up to the date of death must be reported and all credits and deductions to which the decedent is entitled may be claimed. A few states also levy estate taxes as well so you could get.

The government charges it on your right to transfer your property to your heirs after your death. Dying may get you out of a lot of things but not taxes. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

Proposals to tax capital gains at death date back to President Kennedy in 1963 and were proposed by the Ford and the Obama Administrations. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal. The decedents income will count from January 1 of the year they passed until the day before they passed.

Ontario Answer 189 Although there is no death tax in Canada there are two main types of tax that are collected after someone dies. However tax may be due on any interest earned by the death benefit. 396 after 2025 under current law but there is also a budget proposal to raise the rate to 396.

Only a handful of states still collect an inheritance tax. The Estate Tax is a tax on your right to transfer property at your death. This type of tax can be imposed at the state or the federal level.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. These taxes are levied on the beneficiary who receives the property in the deceaseds will. Federal estate taxes and in a few states state estate taxes apply before your property is transferred.

The burden of the estate tax doesnt fall on dead people. 675 for the member and 075 for a surviving spouse pension. In the US there are actually two different kinds of death taxes.

This situation occurs when the payout of death benefits is delayed. They are taxed at the applicable capital gains tax rates.

Taxes On America S Favorite Beverage Soda Infographic Infographic Health Food Infographic Infographic

Pin On Death And Dying Deathternity Blogspot Com

The Tax Professionals At H R Block Know How To Handle Any Tax Problem No Matter How Complicated There S No Tax Return They Cannot Hand Hr Block Tax Tax Return

Pin On Cult Classic Movies I Ve Loved

Is Inheritance Tax Payable When You Die In Singapore Singaporelegaladvice Com

Brylaw Brylawaccounting Brylawaccountingfirm Accounting Incometax Tax Income Tax Tax Lawyer Quotes

Checklist What To Do When A Loved One Dies Edwards Group Llc Funeral Planning Checklist Funeral Planning Estate Planning Checklist

What Is An Estate Tax Napkin Finance

It S Tax Day Have You Filed Your Taxes Yet As Margaret Mitchell Aptly Puts It There S No Convenient Time For Them Life Quotes Margaret Mitchell Quotations

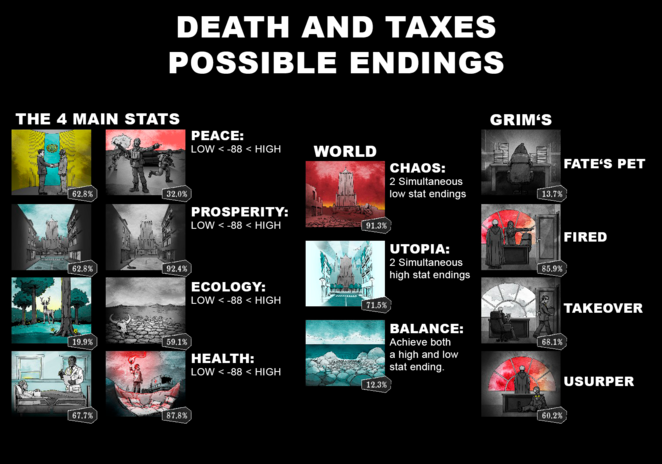

Death And Taxes Endings Guide Neoseeker

Feudalism In Europe Middle Ages Teaching Powerpoint Poster

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)